32+ Debt calculator monthly payments

Amortization tables help you understand how a loan works and they can help you predict your outstanding balance or interest cost at any point in the future. The resulting quotient is the DTI ratio.

Debt To Net Worth Ratio Formula Calculator Updated 2022

A balance transfer is one of the best ways to save money on credit card interest and get out of debt sooner.

. A repayment mortgage means that over the length of the loan you will repay the full amount you borrowed as well as some interest. It is not based on your personal creditworthiness or other factors. A balance transfer wont automatically solve your problems.

This amortization calculator returns monthly payment amounts as well as displays a schedule graph and pie chart breakdown of an amortized loan. This calculator is an illustrative tool only. So Bobs debt-to-income ratio is 32.

A part of the payment covers the interest due on the loan and. Your last loan payment will pay off the final amount remaining on your debt. This was followed by ULIP offerings from Life Insurance Corporation in 1989.

Loan amount Loan terms in years Interest rate. Pay no monthly fees. These are some of the most common uses of amortization.

By listing all of your sources of income against all of your monthly expenditures from required expenses like mortgage or rent payments to discretionary spending like eating out or going to the movies you get a true picture of your personal cash flow which. By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender. 285 to 32.

Homeowners who put less than 20 down on a conventional loan also have to pay for property mortgage insurance until the loan balance falls below 80 of the homes valueThis insurance is rolled into the cost of the monthly home loan. Back-end DTI ratio is estimated by adding mortgage-related debts and all monthly debt payments. Home buyers who have a strong down payment are typically offered lower interest rates.

Car loan or personal loan they usually make monthly payments to the lender. Total lump sum payments. Monthly Yearly Mortgage Payments per Thousand Financed.

An interest-only mortgage means you only pay the interest and once the loan is over eg 25 years after you took it. ULIP plans were first introduced in India by Unit Trust of India UTI in 1971. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year.

However a budget is really just a tool to gain a better and more accurate insight into your spending habits. If youre applying for a debt consolidation loan you might also need to provide information about your credit card or other loan accounts. 32 East 31st Street 4th Floor New York NY.

For example after exactly 30 years or 360 monthly payments youll pay off a 30-year mortgage. Then its divided by your gross monthly income. We take your inputs for home price mortgage rate loan term and downpayment and calculate the monthly payments you can expect to make towards principal and interest.

Total lump sum payments. Repayment terms vary according to lender terms and how much money is borrowed but monthly payments always contain interest obligations. These are often the cheapest ways to borrow money and save on interest with a low interest loan.

Loan might cost in monthly payments by using this calculator. This calculator adds in discount points loan origination fees and closing costs along with any recurring PMI fees into the loans original APR to. Other Monthly Debt Payments.

Use our loan comparison tool to search for the best unsecured personal loans or unsecured loans. 2836 are historical mortgage industry standers which are. 12 Payments of.

Find out how much itll cost to borrow from your retirement with this easy-to-use calculator plus other ways to borrow without risking your savings. A back-end ratio includes your monthly housing costs plus any other monthly debt payments you have like credit cards student loans or medical bills. See how much youll pay.

Plug your numbers into our debt-to-income ratio calculator above and see where you stand. Make at least 1 deposit per month and no more than 1 withdrawal including internal transfers or external payments. The above calculator provides monthly payment estimates for any type of financing breaking payments down into their essential components.

This calculator determines how much your monthly payment will be for your mortgage. The best balance transfer credit cards offer 0 balance transfer APRs that last for the first 15-18 months usually with no annual fee and a balance transfer fee of 3. Balance at end of term.

There are multiple extra payments that you can include such as one time additional payment or recurring extra payments. Set-up to 9 personalised savings accounts and choose to lock as many accounts as you like to earn the maximum variable. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate.

32 East 31st. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Personal loan calculator for monthly payments Enter the loan amount term and interest rate to see the monthly payment and total cost of a loan.

You still must craft a debt payoff plan that. This calculator shows how much you pay each month each year throughout the duration of the loan for each 1000 of mortgage financing. Must enable the Lock Saver feature.

You will not be able to create plans if one or more of your American Express Accounts is enrolled into a debt management program. Includes a monthly plan fee of 832 for a total plan fee of 4992 Total cost. Amortization Schedule with Extra Payments excel to calculate your monthly mortgage payment with extra payments.

Now its your turn. Unit Linked Insurance Plan also allows its investors to switch their investment from debt to equity and vice-versa without running from pillar to post and any worries of being charged. 32 days notice for withdrawal and TCs apply.

Easy Excel Credit Card Payoff Calculator Debt Calculator Etsy Paying Off Credit Cards Credit Card Balance Credit Card Payoff Plan

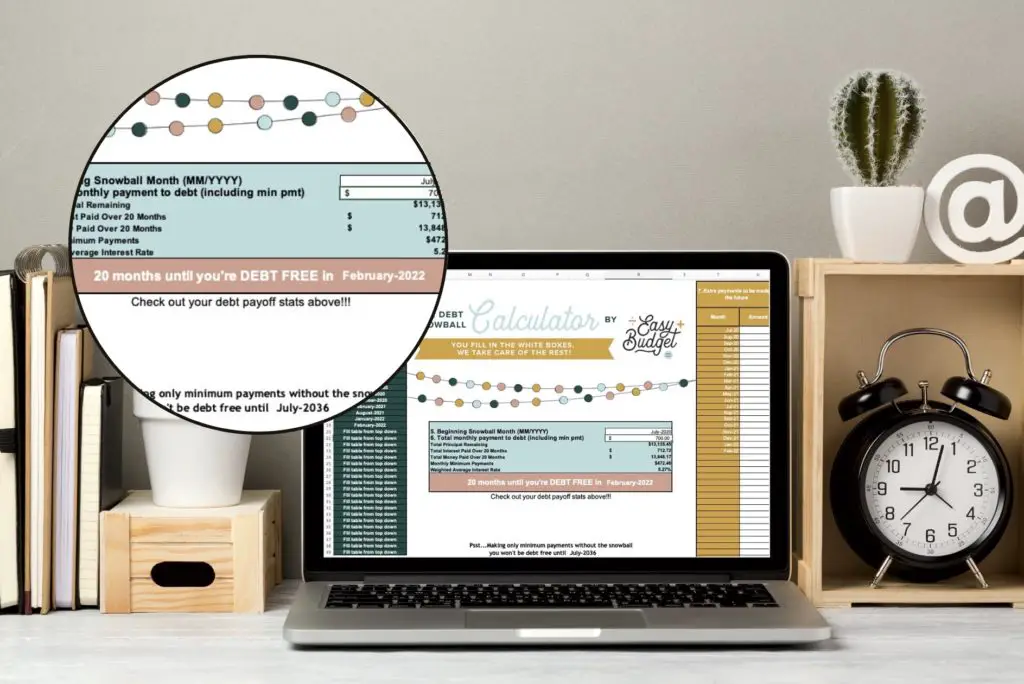

The Best Automatic Debt Snowball Calculator Spreadsheet Calculate Your Debt Free Date Easy Budget

The Best Automatic Debt Snowball Calculator Spreadsheet Calculate Your Debt Free Date Easy Budget

The Best Automatic Debt Snowball Calculator Spreadsheet Calculate Your Debt Free Date Easy Budget

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy Debt Payoff Debt Snowball Calculator Debt Snowball Spreadsheet

The Best Automatic Debt Snowball Calculator Spreadsheet Calculate Your Debt Free Date Easy Budget

10 Free Household Budget Spreadsheets Debt Snowball Spreadsheet Debt Snowball Calculator Debt Reduction

1

The Best Automatic Debt Snowball Calculator Spreadsheet Calculate Your Debt Free Date Easy Budget

1

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy Credit Card Debt Payoff Saving Money Budget Money Saving Plan

1

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

The Best Automatic Debt Snowball Calculator Spreadsheet Calculate Your Debt Free Date Easy Budget

1

Download The Credit Card Payoff Calculator Paying Off Credit Cards Credit Card Payoff Plan Secure Credit Card

Debt Snowball Spreadsheet Debt Payoff Calculator Google Etsy Debt Snowball Spreadsheet Debt Snowball Debt Payoff