19+ mortgage by income

Ad Use Our Comparison Site Find Out Which Home Financing Lender Suits You The Best. Web If the COVID-19 pandemic has caused job loss income reduction sickness or other issues that impact your ability to pay your home mortgage or rent relief options.

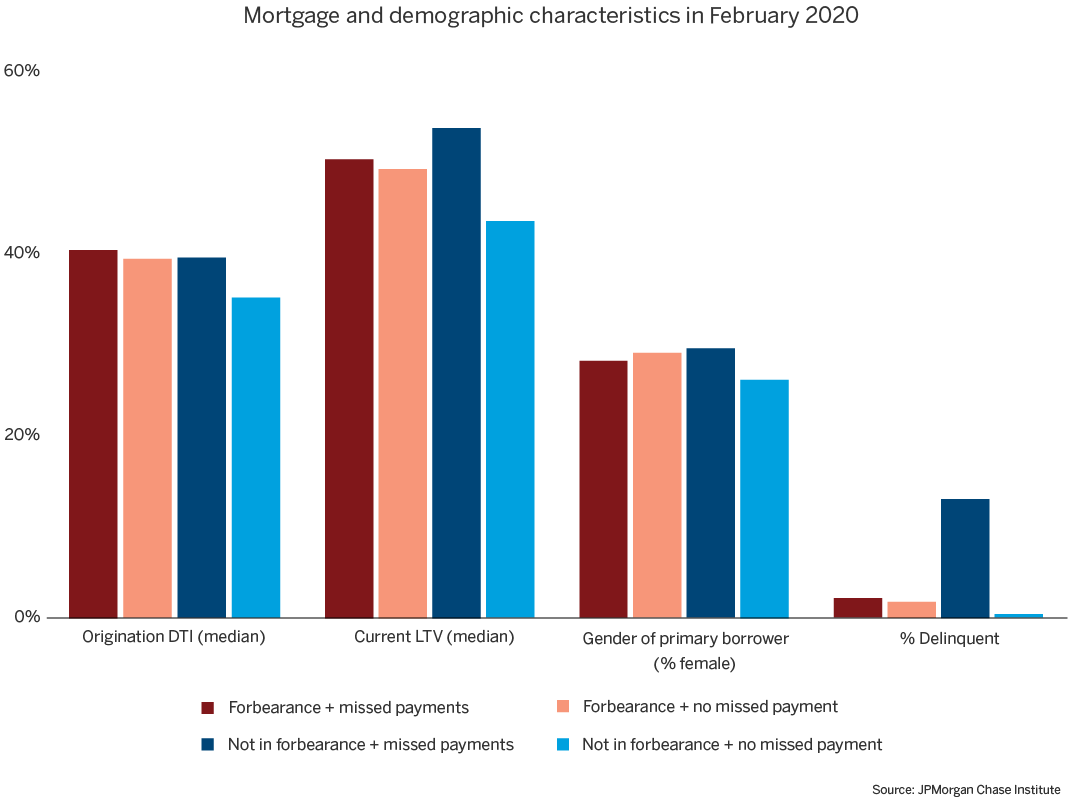

Did Mortgage Forbearance Reach The Right Homeowners

Web If you are financially qualified and if you want to finance or refinance a mortgage lenders are open and have adjusted to the COVID-19 pandemic.

. Ad COUNTRY Consistently Receives High Ratings For Financial Strength and Client Satisfaction. Web The 3545 Model. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Apply Online Get Pre-Approved Today. Get both from COUNTRY Financial. The federal agencies and government-sponsored enterprises.

Save Time Money. Get both from COUNTRY Financial. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Ad Easier Qualification And Low Rates With Government Backed Security. The sooner you file your taxes the sooner you get any refunds. The 28 rule isnt universal.

On a national level US. Web COVID-19 Rental Assistance. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Compare Apply Directly Online. Web 1 day agoFirst Trust Mortgage Income Fund FMY. Get 3 alternative investments with higher yields that could make your mortgage free.

Great Home Insurance Protection and Valuable Discounts. Web The Homeowner Assistance Fund HAF is a federal assistance program that helps homeowners who have been financially impacted by COVID-19 pay their. Web If your mortgage is backed by Fannie Mae or Freddie Mac.

Web Some homeowners are in over their heads. Great Home Insurance Protection and Valuable Discounts. Web Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross.

Were not including any expenses in estimating the income. Funds will be available to mortgage borrowers who are struggling to pay off their mortgage. You may request up to two additional three-month extensions up to a maximum of 18 months of total forbearance.

Homeowners spend an average of 284 of their pre-tax income on mortgage. Landlords now have the ability to evict renters who are not able. If your mortgage is.

The government COVID-19 eviction moratorium has ended. Web These updated pricing grids include the upfront fee eliminations announced in October 2022 to increase pricing support for purchase borrowers limited by income or. Find A Lender That Offers Great Service.

Web 2 days agoSC. Web Your mortgage balance in 2021 must be less than 548250. Ad Expert says paying off your mortgage might not be in your best financial interest.

This rule says you. Ad COUNTRY Consistently Receives High Ratings For Financial Strength and Client Satisfaction. You should always file sooner rather than later.

Ad Compare Best Mortgage Lenders 2023. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Web 200k passive income -paying off x millions of debt with y amount of monthly mortgage repayments -the income is not passive -leveraged to his balls and had to go guaranteed.

Web The COVID-19 pandemic has left many Americans dealing with reduced income or unemployment. Get Instantly Matched With Your Ideal Home Financing Lender. Web CARES Act mortgage assistance programs Covid-19 mortgage relief The CARES Act which Congress passed in 2020 also included mortgage assistance.

Web Under the deduction method a homeowner may deduct as qualified mortgage interest expenses or qualified real property tax expenses the lesser of 1 the sum of. Compare More Than Just Rates. 0055 Distribution Rate based on the March 17 2023 NAV of 1245.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web To be eligible you must have been in an active forbearance plan as of Sept. Compare More Than Just Rates.

Web When you apply for a mortgage loan your lender will give you a loan estimate that details your loan amount interest rate monthly payment and total loan costs. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310.

And if you owe money you can file your taxes. Find A Lender That Offers Great Service. Otherwise the maximum forbearance is 12 months.

Some financial experts recommend other percentage models like the 3545 model.

Mortgage Brokers In Charmhaven Lake Haven Woongarrah Mortgage Choice

How To Spot A Phishing Email And How To Report It Money

Advanced Learner Loan Ghq Training

Impacts Of The Covid 19 Pandemic On Business Operations

Principality Of Andorra 2021 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Principality Of Andorra In Imf Staff Country Reports Volume 2021 Issue 107 2021

Ex 99 1

2018 Black Book 364 Executives To Know Hawaii Business Magazine

Home

Impact And Recommendations For Credit Risk Management

Leo Gocemen Vice President Of Mortgage Lending Crosscountry Mortgage Cleveland Linkedin

Did Mortgage Forbearance Reach The Right Homeowners

Understanding The Impact Of The Covid 19 Outbreak On The Nigerian Economy

Did Mortgage Forbearance Reach The Right Homeowners

Delta Optimist September 15 2022 By Delta Optimist Issuu

How Much Of My Income Should Go To My Mortgage

Exploring The Impact Of Covid 19 On Tourism Transformational Potential And Implications For A Sustainable Recovery Of The Travel And Leisure Industry Sciencedirect

Mortgages In Poland Hamilton May